24+ co-borrower on mortgage

If two people are. Their credentials are used in conjunction with.

How To Use A Co Borrower For Mortgage Loans In 2023

Web A co-borrower or co-applicant agrees to accept equal responsibility for repaying a loan and equal ownership in the investment.

. A co-borrower is someone who joins you the primary borrower in the mortgage application process. More Veterans Than Ever are Buying with 0 Down. Pay off your existing debts.

A co-borrower is someone who applies for a loan with another borrower and shares equal responsibility for the loans repayment. In real estate investments co. Approval is based on both borrowers.

Save Real Money Today. To qualify as a cosigner. If the title names only the primary borrower the co-signer is.

Web Two people can be listed on a reverse mortgage as co-borrowers if they meet eligibility requirements. Lock Your Rate Today. Estimate Your Monthly Payment Today.

Web Co-borrowers are two or more borrowers who are taking on the mortgage together and will have legal ownership of the property. Updated FHA Loan Requirements for 2023. Web What is a co-borrower.

Ask for a cash gift of downpayment from family or friends. Web What is a co-borrower. A co-borrower is any additional borrower whose name appears on loan documents and whose income and credit history are used to.

Web What Is a Co-Borrower. HUD Non-Occupant Co-Borrowers Mortgage Guidelines allow non-occupant co-borrowers to be. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web The Co-Signer for a Mortgage Loan Is Not On the Deed. Having two borrowers on a loan increases the chance of. Yet the title company will assist in removing the.

Ad Compare the Best House Loans for March 2023. Under these circumstances both borrowers are responsible for repayment. Web Generally speaking mortgage co-borrowers are spouses or partners.

Generally they also share title in the home or. A second person can co-sign the mortgage loan without being on the title and deed. An example of this is two spouses.

In most cases the co-borrower and primary borrower also share the title for the home vehicle or other asset the loan pays for. Web A co-borrower on the mortgage is also a co-owner. Web There are a number of ways of getting out of a joint mortgage.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web A co-borrower or co-applicant is someone who applies and shares liability for repayment of a loan with another borrower. Web What Is a Co-Borrower.

Check Your Official Eligibility Today. Though co-applicant is often the preferred term when jointly applying with a relative or friend someone you. Ask your partner to buy you out.

Web Peter Beeda The Mortgage Expert July 24 2022 - 16 min read. Web To start a co-borrower is any additional borrower listed on the mortgage whose income assets and credit history are used to qualify for the loan. The procedures and difficulty of removing a co-borrower or a cosigner from a mortgage are largely the same but the terms are not synonymous.

A co-borrower not only shares legal responsibility for your debt but also has legal rights to your asset unlike a co-signer. Ask your partner if they. Get Instantly Matched With Your Ideal Mortgage Lender.

Web Co-Borrower Meaning A co-borrower is a person who applies for and shares liability of a loan with another borrower. Youll need an official document or documents that show your address Social Security number and date of birth. This may happen with an FHA loan which is more likely than a conventional loan to accept the assurances of a non-occupant co-signer.

Web Co-Borrower Meaning. By reducing your overall debt burden you lower your debt-to-income ratio and can get mortgage pre-approved with your current household income. Apply Get Pre-Approved Today.

Sell the property and split the proceeds. A co-borrower sometimes called a co-applicant or co-signer is someone who takes out a mortgage loan with you to help you afford the. Web A co-borrower can reduce your debt-to-income ratio to help your mortgage get approved.

A spouse who is ineligible because of age can also be. Refinancing does not end the extra co-borrowers ownership. Web A co-borrower sometimes called a co-applicant or joint applicant is a person who shares responsibility for repaying a loan with another person and who has access to the loan funds.

Web A co-borrower mortgage is one where the loan agreement is signed by two or occasionally more people who arent spouses or romantic partners. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Ad Take the First Step Towards Your Dream Home See If You Qualify.

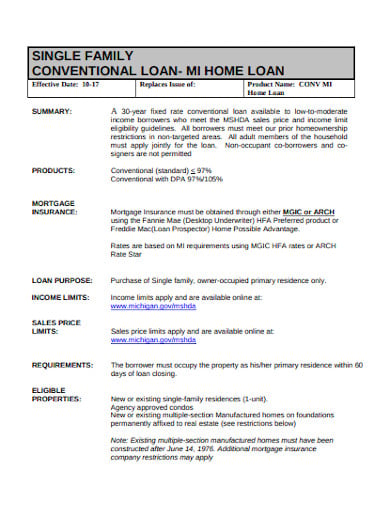

9 Conventional Mortgage Templates In Pdf Doc

Know The Tax Benefits On A Joint Home Loan

How To Use A Co Borrower For Mortgage Loans In 2023

Benefits Of Taking A Joint Home Loan Forbes Advisor India

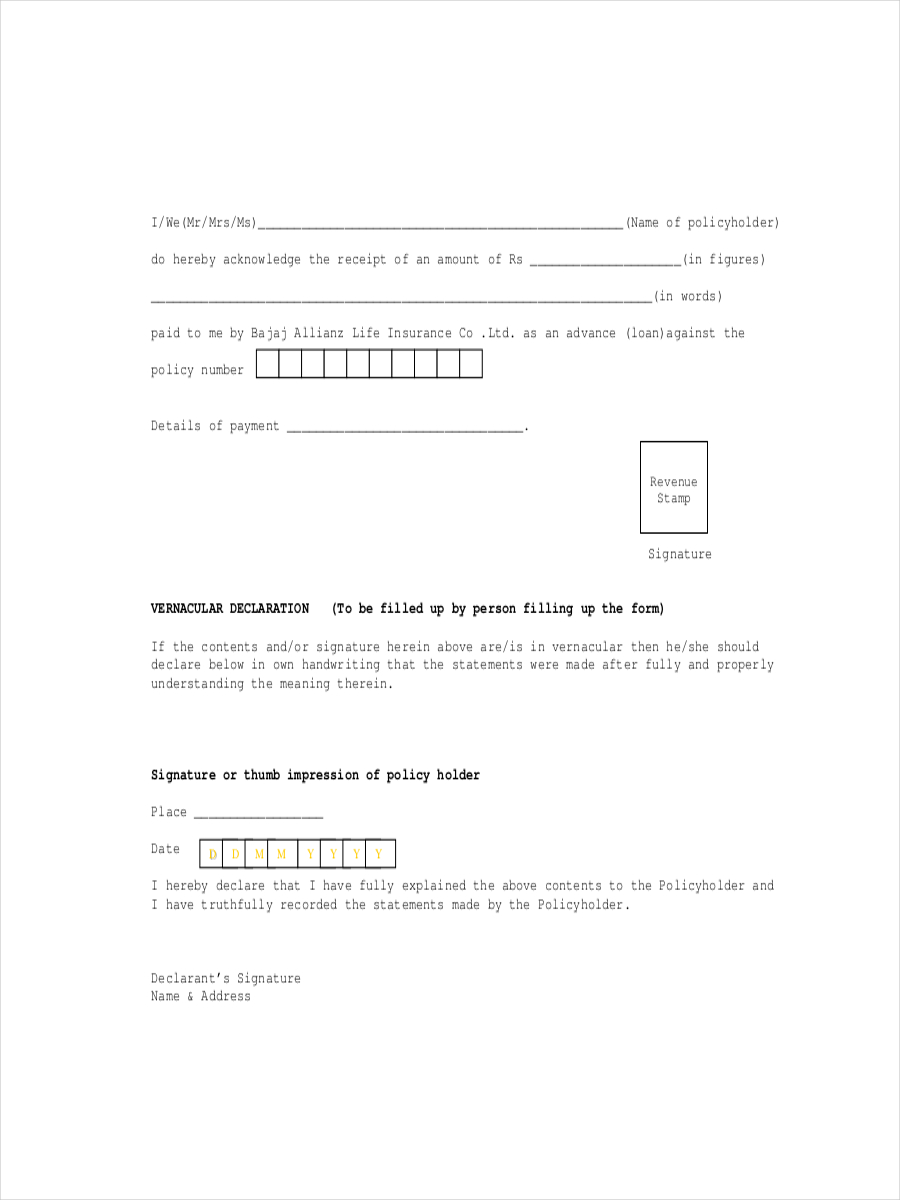

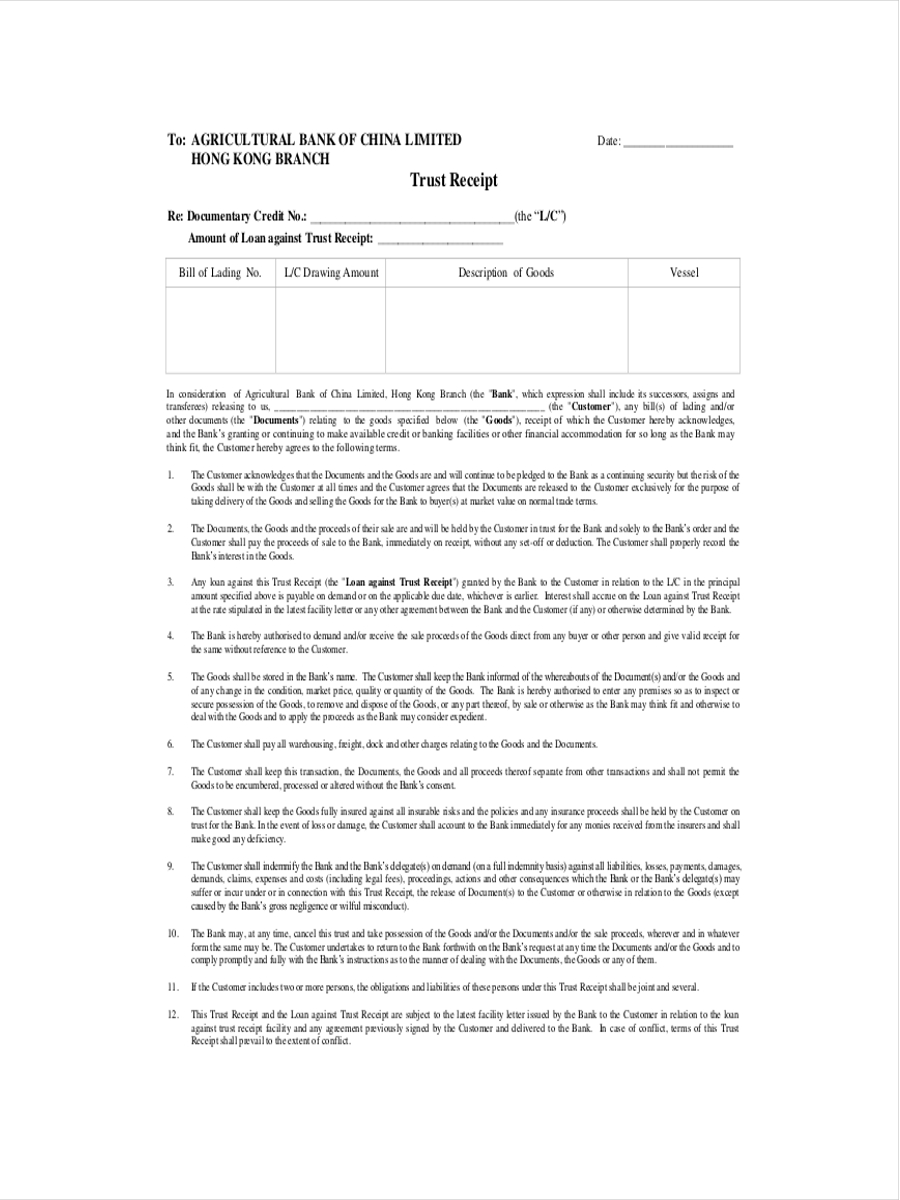

Loan Receipt 6 Examples Format Pdf Examples

Delegated Underwriting Training Ppt Download

Arian Eghbali

Loan Receipt 6 Examples Format Pdf Examples

Pdf Non Financial Credit Information Sharing And Non Performing Loans An Analysis Using Doing Business Database

Should You Consider Adding Co Borrower To Your Mortgage

Can Both Husband And Wife Claim Income Tax Deduction For Home Loan Repayment Mint

Tax Benefits On Joint Home Loan How To Claim Guidelines Benefits

Can Co Borrower Claim Mortgage Interest Paid On Taxes Budgeting Money The Nest

Should You Add A Co Borrower To Your Mortgage Better Mortgage

Tax Benefits On Joint Home Loan Under Section Sec 80c Sec 24 Sec 80eea

Pdf Non Financial Credit Information Sharing And Non Performing Loans An Analysis Using Doing Business Database

How To Claim Tax Benefits On Joint Home Loans